From intelligent agents to fraud detection, AI is transforming every aspect of the finance industry. Building AI applications for this industry can be uniquely challenging given the number of regulations and legal requirements—model accuracy becomes mandatory.

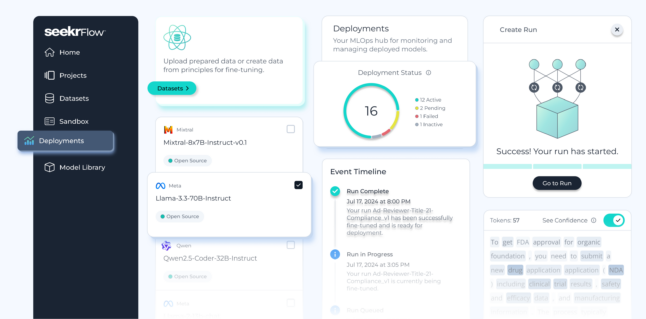

At our recent FinTech AI Founders Summit, we broke down the process of creating a compliance-focused AI chatbot to automate and optimize the handling of financial regulations in AI applications. You’ll learn how our AI platform, SeekrFlow™, simplifies the process of tailoring an AI model to serve a specific business purpose while ensuring it operates within predefined guidelines or rules.

The use case: helping financial teams tackle financial crime compliance with greater accuracy and speed

Our use case focuses on an enterprise consulting firm that needs to provide a large portfolio of clients with up-to-date, accurate information on evolving financial regulations, such as anti-money laundering (AML) laws.

The challenge: The total cost of financial crime compliance (FCC) is skyrocketing due to a combination of ever-evolving regulations, problems with data quality, and resource constraints. Financial institutions need a faster, more accurate way to detect risks and ensure compliance standards are met.

The solution: Create an AI compliance chatbot for the enterprise consulting firm that can provide clients with accurate, real-time information on the latest financial regulations and reduce the firm’s overheard costs. This AI application will deliver precise answers at scale about topics such as cross-border payment regulations or quarterly updates from regulatory bodies like the Financial Crimes Enforcement Network (FinCEN).

Step one: generating a training dataset with Principle Alignment

Building an AI chatbot that can handle the complexity of regulatory compliance requires high-quality training data. This is where SeekrFlow’s Principle Alignment feature comes in.

Principle Alignment simplifies the traditionally complex process of data preparation and model fine-tuning with an autonomous agent that prepares the customer’s ideal training dataset, including data generation, synthesis, augmentation, labeling, and curation.

To build a chatbot for regulatory compliance, we can easily ingest essential compliance documentation—like the latest AML regulations—and structure this information into a knowledge graph that the agent will use to generate the dataset for fine-tuning.

Learn how OneValley transformed its user experience with the SeekrFlow AI platform

See Case StudyStep two: fine-tuning the model for regulatory expertise

Once the needed regulatory content is ingested and the data is prepared, the next step is to fuse this domain-specific knowledge with the AI model.

In our regulatory compliance example, the chatbot becomes a finely tuned regulatory expert, capable of answering highly specific questions such as, “What’s the latest AML regulation for cross-border payments?”

Ensuring a comprehensive knowledge base

To ensure the chatbot continues to provide relevant insights, we also need to integrate additional documentation when real-time insights are needed. Regularly ingesting FinCEN’s quarterly analyses and trends leveraging Retrieval Augmented Generation (RAG) will further enable the chatbot to deliver regulatory insights that are accurate and up to date.

Step three: using guardrails to ensure the model performs within boundaries

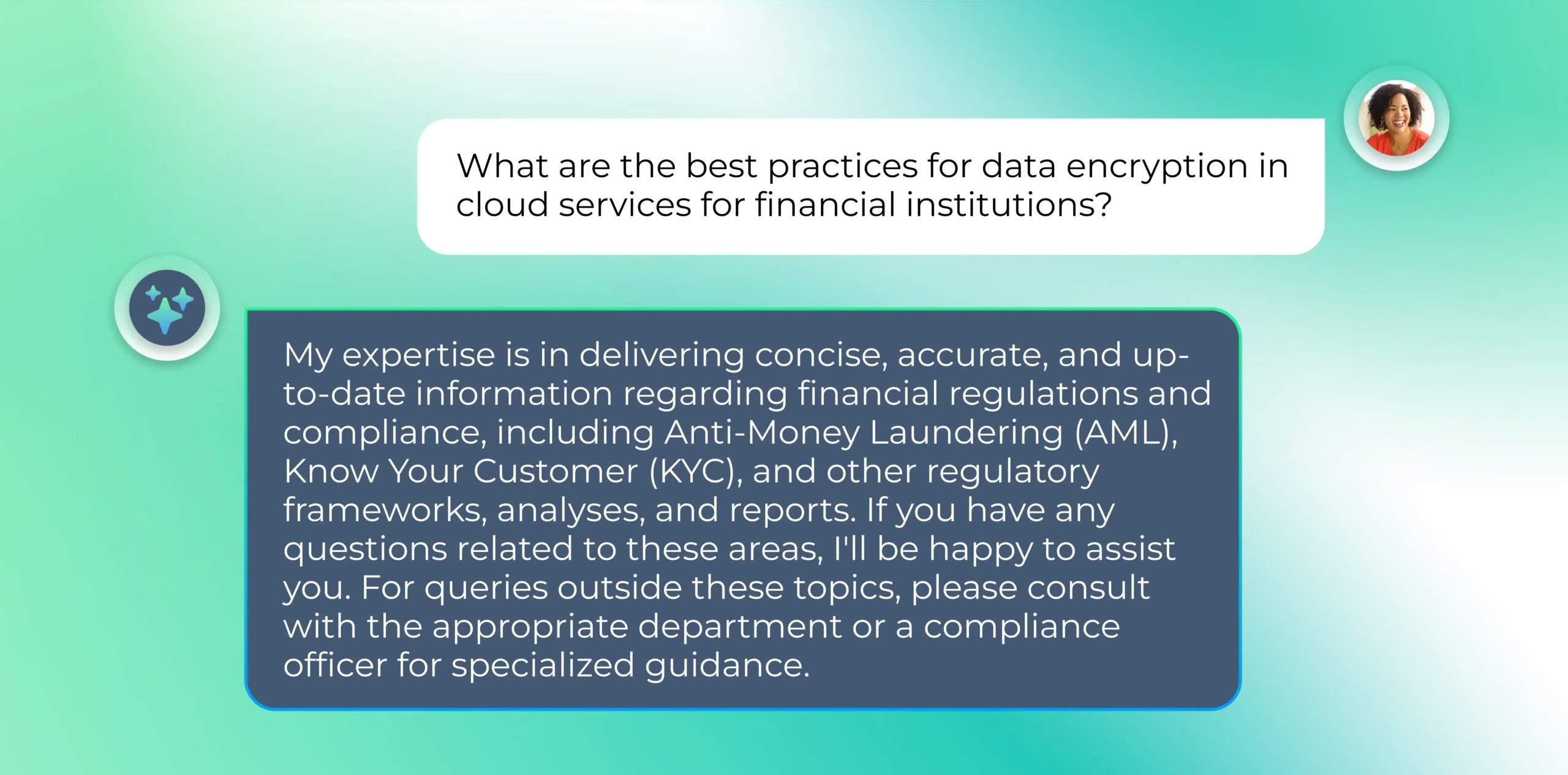

Guardrails help prevent AI from veering into areas outside its expertise. In the context of our regulatory chatbot, this is crucial. We don’t want the model to answer questions outside of the regulatory space, such as technical queries about data encryption or cloud computing.

By using off-topic detection, the chatbot can gently redirect users back to its domain of expertise. For example, if a client asks a question about data encryption, the AI could respond by providing relevant regulatory insights instead, guiding users back to the core compliance topics. This promotes trust and safety in the AI application.

Step four: monitoring and continuous improvement

Deploying an AI solution doesn’t end once the system is live. It’s important to continually monitor performance, especially to track accuracy and context alignment. Implementing feedback loops allows you to quickly address underperformance or unexpected outcomes, learn from user interactions, and improve model performance over time.

It’s important to understand success metrics for your specific use case. For our regulatory compliance chatbot, accuracy in delivering the most current financial regulation data is critical, but other metrics like user engagement and response time may also be considered.

With guardrails in place, feedback mechanisms, and clearly defined success metrics, you’ll be able to continuously improve and offer the kind of value your business and end users are seeking from your AI solution.

The result: fast, accurate financial compliance insights that reduce overhead costs

In this example, we’ve demonstrated how to build a compliance-focused chatbot that delivers real-time, accurate financial regulation updates. This AI-powered solution helps regulatory compliance teams save time and resources by automating research, reducing manual effort, and minimizing the costs associated with financial crime compliance. Streamlining access to accurate information, the chatbot enables better-informed decisions and enhances efficiency for both the firm and its clients.

If you’re interested in exploring how to build a trusted AI solution for the finance industry using SeekrFlow, reach out to our team for a free 30-minute consultation.